This summer, the local market has decisively swung in buyers’ favor, as home sellers around Washington have had to contend with both softening demand, and more abundant competing listings. That’s good news for home buyers, but we are seeing fewer of them than we saw last year.

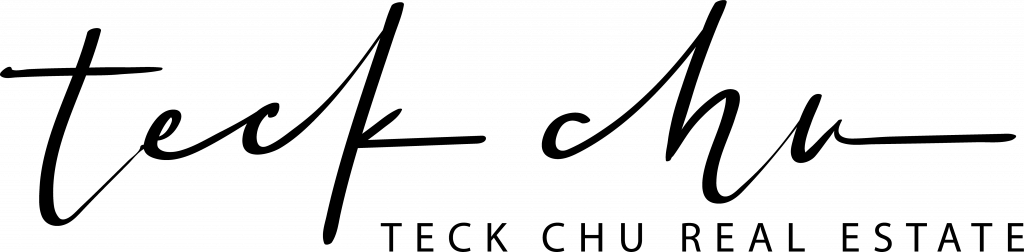

In August, closed sales of residential homes came in 6% below last year’s August total, across the Northwest MLS. Pending sales, which give some signal about next month’s sales, were roughly flat – up just 1% form last year.

On the supply side, we’ve passed an inflection point, where sellers are starting to back away from the market. There were 2% fewer new listings than last August – the first year-over-year decline in new listings since February. The month ended with 31% more active listings than last August, marking a slowdown from the inventory growth of about 36% the last two months. This pullback in supply should put a floor under any potential price decreases that the market shift could bring.

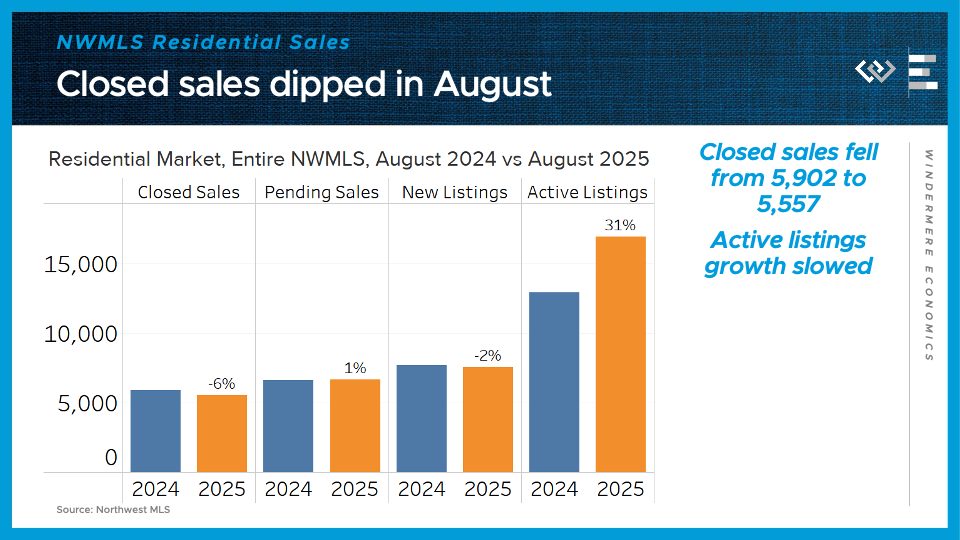

Speaking of which: the steadiest number across the Northwest MLS has been median sale price, which was exactly the same as last August: $665,000. That’s two months in a row of flat annual price changes, but it remains about 5% higher than in 2023.

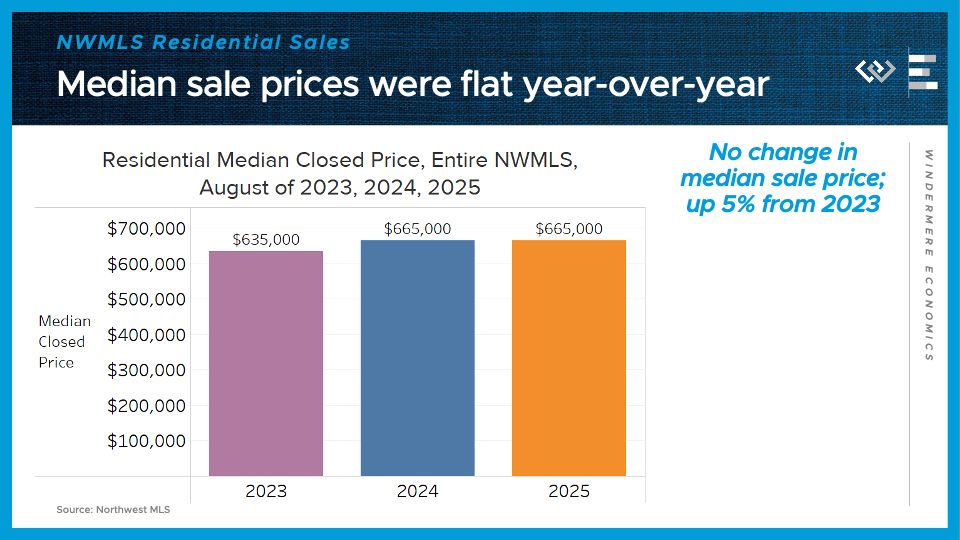

Now I’ll take a closer look at the four counties encompassing the greater Seattle area.

Closed sales dipped by almost 6% from last year. Only Pierce County saw a gain, albeit tiny, from last August.

Median sale prices actually crept upward from last year in all 4 counties: 4% higher in King; 7% higher in Kitsap, 1% higher in Pierce, and 1% higher in Snohomish County.

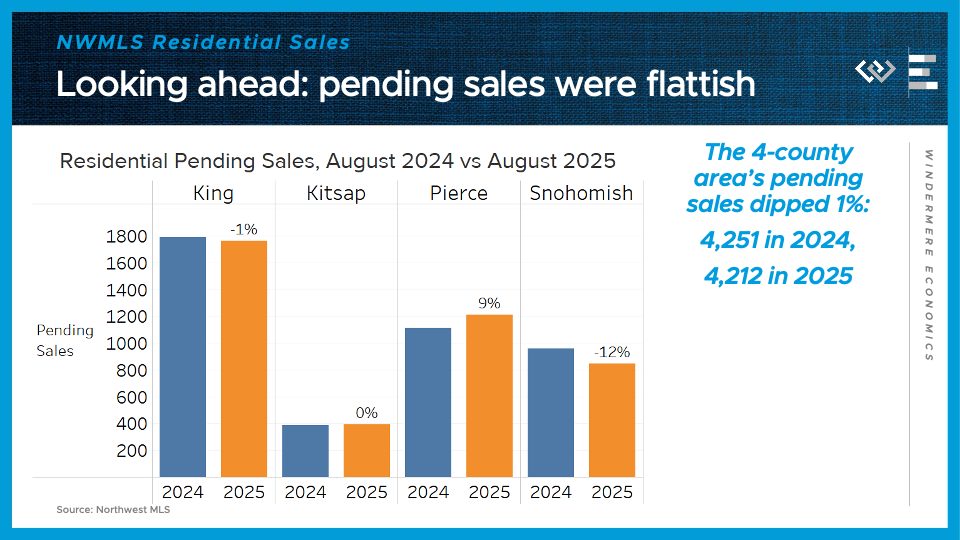

Looking ahead, pending sales dipped 1% across the region, although Pierce County was again the standout for sales, with 9% more pending sales than last year.

On the supply side, the 4-county greater Seattle area had 32% more active listings than at the end of August 2024. That continues the moderation of inventory growth we’ve seen since May, when this metric peaked at 45% year-over-year growth. King County especially has rebalanced, down from 50% growth to just 32% active listings growth.

Looking ahead, the key question is whether buyers begin to come off the sidelines in response to these more favorable conditions: they’ve got lots of inventory to choose from, listings that have lingered on the market, and mortgage rates that have dipped from about 7% to closer to 6.5% this summer. For people in a position to buy, this fall is looking like a sweet spot.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link